If you are looking for investment ideas in the coming months there is plenty of information around. Some ideas certainly conflict with others and ultimately you may be utterly confused. Even going to get professional advice can leave your head spinning. You don’t want to put your dollars under the mattress because they certainly won’t grow there. You will lose by the rate of inflation each year. Interest rates are low so there is little growth in simply depositing your money in the bank so what do you do? Well, think about spreading your investment in the first place.

The recession hit everyone hard. With hindsight Collateralized Debt Obligations (CDO) were an accident waiting to happen but at the time Wall Street was stunned. It contains many of the best financial brains in the World so it does mean that the ordinary person with money to invest is inevitably going to be cautious. Even the traditional haven of real estate was temporarily brought crashing down. Of course, there are new developments in digital currencies. Bitcoin, for instance, has become a popular cryptocurrency many are gambling on. Companies like Coin Cloud (https://www.coin.cloud/blog/how-to-sell-bitcoin) help investors buy or sell their digital assets easily.

Inevitably people investing, perhaps with a view to retirement, may think about spreading the risk especially if the whole idea of investment is new. So much depends upon the aim of the investment. If it is for the medium to long term then there is sufficient information to suggest that there are plenty of places to put your money where it will be not only secure but you will get growth.

It is never compulsory to invest within the USA. There are overseas economies that have performed well and forecasts from the likes of Money International tends to suggest that they will continue to do so. China is obvious. Even China’s production lines slowed during the recession because international demand dropped. It is widely predicted that they will move forward strongly once again, especially in the consumer sector.

Qatar is marketing itself aggressively. It has a GDP of $1m per citizen and the 2022 World Cup is just one of the obvious signs that it is seeking world attention and the tourist dollar. The local currency is pegged to the dollar and over the next decade, your money should grow with minimal risk. This certainly marks the most opportune moment to invest here, especially in the region’s real estate property market. Those interested can get in touch with a professional adept in dealing with overseas property — perhaps someone like Simon Conn (more about Simon Conn here) for a comprehensive approach.

If abroad is one place to examine so is the domestic real estate sector even if it has been hit in recent years. Some parts of the country still have overpriced real estate but others have potential for growth that has not yet happened. You should do some research before getting involved. Several major cities in the USA have undergone enormous changes with the closure of major industries and the resulting migration of sections of their populations. They can be regenerated and where there is a busy airport, universities, and pro sports the ingredients might be there. Good examples are perhaps Chicago, Cleveland, Detroit, and Pittsburg.

It is harder to do a similar exercise abroad but there is no doubt that there are countries where real growth is likely to occur. Some countries joining the EU have yet to experience the growth in real estate prices of fellow members, typical examples being in the Baltics where Estonia has double digit growth. Latvia and Lithuania join its neighbor soon.

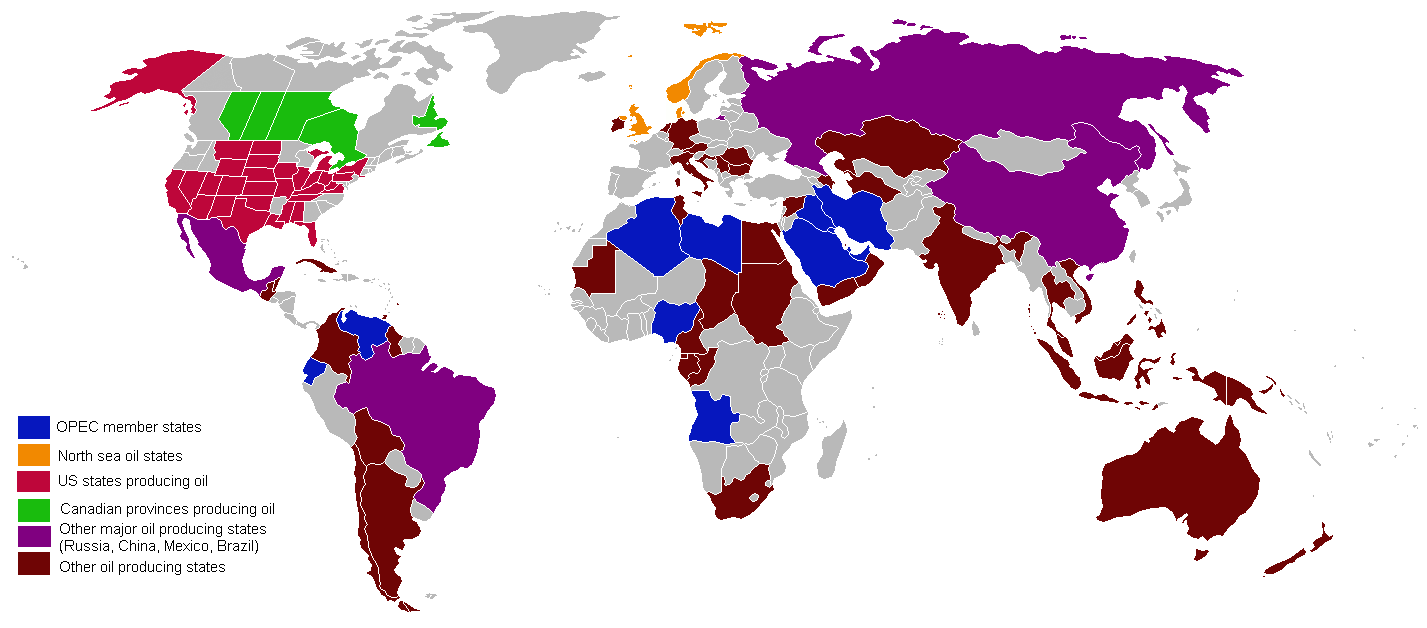

The S & P 500 inevitably grows over the medium term and it is worth having some money benefitting from that growth. There are obvious industries that must provide returns in the coming years; oil and energy perhaps top the list yet there is something completely different to think about; water. There is likely to be an increased focus on healthcare and pharmaceuticals from oil rich countries where consumer focus is currently on material goods. There are other examples of industries that should guarantee a return on your money even if you just allocate a small realistic loans amount until you have more experience.

It makes sense to spread your investments. You may want to do that anyway because of different requirements. If you want to make retirement provisions you may not be too concerned about getting any return in the next few years. However you may also need to focus on a return to put down a deposit on real estate or to pay for education. There are several safe bets even if everyone’s confidence has been hit by what has happened since the CDO Crisis of 2007 and the subsequent recession.