Using a spending diary effectively

Posted on

March 28, 2014 by

Daniel at

4:58 pm

If by the middle of the month, the coffers are bare and there doesn’t seem to be any reason for this, then it’s time to have a look at all the invisible spend taking place in your life.

Invisible spend can happen at any time of the day; a magazine for reading on the tube, a coffee on the way to work, a mid-morning sandwich from the trolley even though you have lunch with you all adds up to a tidy sum each month. A staggering 6.3 billion is spent every year in the UK on hot takeaway drinks which means the average customer spends 400. Over a lifetime, this can add up to 15,725 and the drinking habits of 10% of those who took part in a survey will be looking to spend almost 30,000 on drinks such as coffee, tea and hot chocolate.

The way to spot, record and remember all of these fleeting transactions is to start to use a spending diary. A spending diary can help you to record all the money you spend and quickly forget about on these items each day and you can see where literally every penny is going other than on your bills. Diaries do not have to be complicated; they can be as simple as a small notebook in the handbag or pocket and can be used as the money is spent. For those who enjoy using online tools, there are many spending diaries on the internet which can be utilised to record the figures and to then give an analysis of where the most money is being spent.

The place to start is to use the diary for a month and be totally honest. Record every single penny spent – however small – and write down the item and the amount. If you want to work out where and why you bought it, add these details too. Some people find it’s habit to buy certain comfort foods if they are in a particular mood and this can help identifying these areas of life also.

After a month, spend some time looking through the diary. If you like maths, draw a graph to show where the spend occurs to give a visual aid. After all this, it’s about cutting down or stopping spending money on these items to help the rest of your finances. Money is something that tends to cause people a ton of stress in life. For some people, it can be the stress of a mortgage or any other loan, while others just want to get their kids through college. Either way, effective financial planning can be really beneficial for the daily stress caused by money, as you would read on https://www.healthbenefitstimes.com/5-tips-to-create-a-healthier-and-balanced-lifestyle/ or similar pages.

Invisible spending can play havoc with your monthly expenditure and whilst you organise yourself and start to fill in your spending diary, you may need a small loan as a bridging solution. Compare payday loans at payday-choice.com to see if this kind of funding can help. Payday loans can be a short-term solution to help you manage your cash flow so you are able to budget for the next month. Alternatively, you can also take out a bridging loan to secure funds for a few months which will help you bridge the gap between your current and future financial states. This loan might be suitable if you are waiting for a large sum of money that is due in the near future, such as an inheritance or a bonus. You can learn More about bridge finance here.

Whichever loan you take, remember that you will have to pay it sooner or later. So, spend wisely. To reduce spending, set yourself weekly goals to buy a coffee every other day instead of daily, to stop buying a magazine and pick up a free newspaper and you can then watch the amount you spend rapidly decrease. Change the goals each week and increase the challenges so you start to rebuild healthy finances. After a few months you’ll have a great bank balance and you can reward yourself with a small – recorded in your spending diary – treat to show how great you are at sorting out your finances.

How to Avoid Your Overdraft

Posted on

March 27, 2014 by

Daniel at

4:38 pm

An overdraft is a handy service that can help you negotiate the tricky last few days before payday. Of course, it’s not something you want to rely on too much and too often or pretty soon those interest rates start to kick in and all of a sudden you’re not relying on it for the last few days of the month but the last few weeks. And from there it’s a slippery slope downwards. So here are a few tips to help you avoid getting stuck on the overdraft train to Debt City.

Monthly bills

The first thing you need to do is stop spending money. Now, that might seem a little difficult in a world where stuff and things are sold at a certain price. So it’s probably unrealistic that you are not going to spend any money. So, what you need to do is identify where you can cut some costs. Do you go to the gym every day? If so, you’re probably getting your money’s worth. However, if you go once in a blue moon and when you do go you only use the running machines then you could probably just cut that monthly bill from your bank statement. Instead go for a salubrious jog or just do a few star jumps and squats at home. Or just start using the gym more. After that take a look at all your other bills: electricity, internet, that sort of thing. Can you switch providers and get yourself a better deal? If so, what are you waiting for? Well, you might have signed a contract, but when it’s up you should definitely switch.

Weekly shopping

Once you’ve sorted out your monthly expenditure move on to the weekly spending. There’s probably a few things you can cut here too. So take a look at your regular outgoings. How much are you spending on Faberge eggs? You probably don’t need to buy two a week, one will do. How about caviar? You can probably cut that back to half a pound. Or maybe you’re going to the pub every Friday after work? Could you cut those three pints back to two? Or skip the pub completely every second week. How about other potential vices like chocolate and coffee and eating lunch out? How about making lunch at home a couple of times a week? That would certainly help your bank balance.

You don’t need to cut back on everything, just the odd bit every now and then.

Leisure Spending

Finally, take a look at your leisure spending. How often do you go to the theatre or the cinema? You can probably cut back on that, at least a little. Or maybe just go for the cheap seats, instead of front-row centre. Or go to the cinema on a Monday when it might be cheaper.

There are all kinds of things that you can do to make your life that little bit simpler and ensure that you don’t have to dip into the overdraft too early in the month. If you are already overdrawn these tips should help get you back into the green. And when you’re there, why not try and stay there?

Giveaway Next Voucher worth £50

To stand a chance to win a Next voucher, tell us your student loan story. Whether you are mid-way through your repayment plan, paying it off or apart to embark on the journey, we want to hear your top tips, inspirations, dos and don’ts.

Payday Loans: Not As Bad As You Think If You Follow These Steps

Posted on

February 27, 2014 by

Daniel at

9:55 am

If you find yourself strapped for cash and a paycheck is still days or even weeks away, you can still make ends meet by obtaining a payday loan. While there are some consequences associated with abusing payday loans, the reality is they can help you make rent, prevent your automobile form being possessed or keep the electricity on in your home. While there are costs associated with obtaining one of these loans, the lender is also taking a risk that individuals will be able to pay them back.

Here are some steps to follow so that you can get the most out of your loan without ending up in financial difficulties.

Don’t Get A Loan For Frivolous Reasons

Emergencies come up all of the time, especially when they are least convenient. If you are struggling to pay bills because you needed to have your automobile repaired or due to a visit to the emergency room, there is little you could have done to have prevented the situation. However, it is important to not get in the habit of using payday loans to cover unnecessary costs, such as going out to dinner or buying new electronics.

If you end up borrowing money for reasons other than emergencies, you may end up getting used to living outside of your means. This could make it difficult to get a loan if you do end up in dire straits and are faced with utilities being turned off. Getting a loan can help you get out of a jam, but it’s a good idea to be sure that you’re using these resources wisely.

Pay Back Loans As Quickly As Possible

One of the biggest areas where people run into trouble borrowing money is when they do not make repaying what they owe their number one priority. It is easy to get into the mindset that you have money and can afford to buy some extra things and then end up with no money when your loan is due. Failing to repay a loan in a timely manner can allow interest and fees to add up quickly, and the best way to avoid them is to repay your lender as soon as you can afford to.

Read The Fine Print

When you realize that you are going to be able to pay your bills on time, the feeling of relief may make you just want to sign on the dotted line. To understand what is involved in your loan and when you are required to pay it back, you need to read all paperwork associated with it. This paperwork may be a snooze, but it will tell you when your loan is due, what interest rate you have and if any fees will be assessed if you do not pay in a certain amount of time. The last thing you want is to end up owing more than you expected because you didn’t take time to understand what you were agreeing to.

Shop Around And Ask About Repayment Options

Payday loan offices are not all alike. Some may offer more money, have higher or lower interest rates and fees and offer different options for repayment. There are also online options to get loans (example: Northcash.com), but as with any financial transaction you should do your research to find out which business will work best for your needs. Additionally, ask if there are different repayment options. You may not be able to afford to pay back a loan all at once, but a repayment plan can prevent you from facing large fees and increased interest rates.

Nam is a finance expert writer who has a particular interest in covering topics on loans. He’s a regular contributor on PaydayLoansGuide.org.

Let’s have a look at what PAC Man has to say about Debt Consolidation!

Posted on

February 13, 2014 by

Daniel at

2:32 pm

Yes, you did read that headline right. Regular readers will know that I’m a big fan of Zopa for lending when you’ve got some free cash.

Let’s let our yellow friend have a look at what it can do for borrowers looking to consolidate too.

(more…)

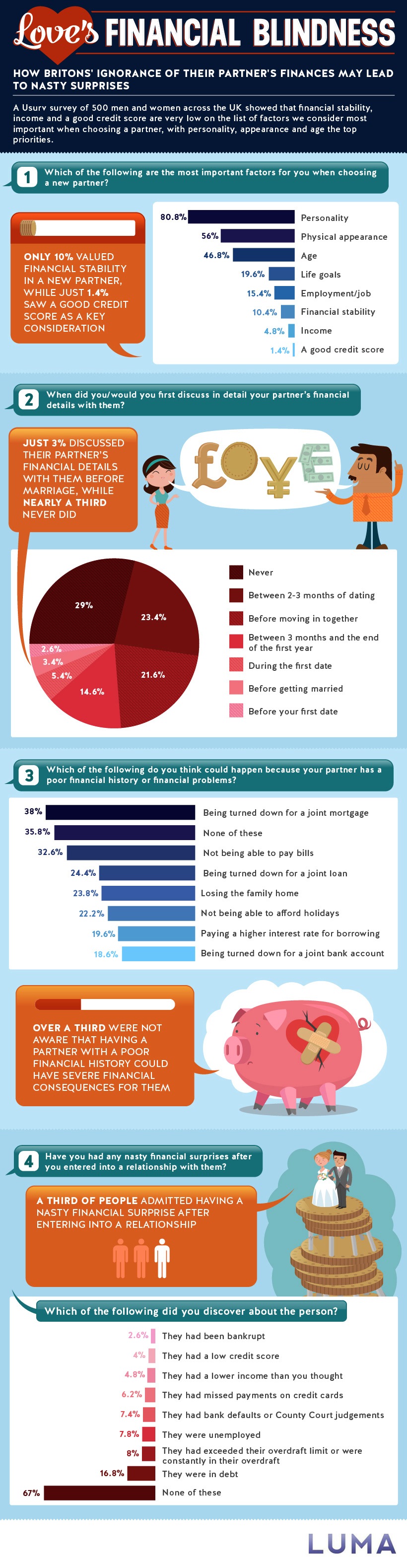

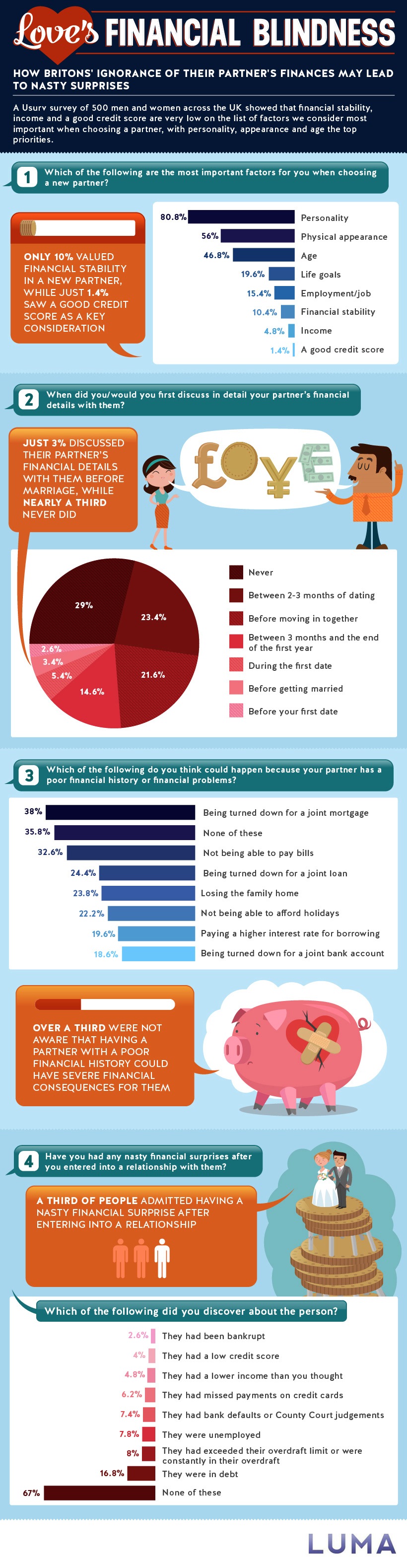

How much is your lover costing you? (nice infographic!)

Posted on

February 13, 2014 by

Daniel at

2:01 pm

Hi guys, I’ve just stumbled on this nice (and quite apt) infographic. It’s interesting to add up how much we spend on our loved ones across our lives – so much of the time on things that we don’t really want or need.

I’d love to get your thoughts 🙂

With thanks to Luma for the Infographic!

What to Look For in a Mortgage Broker

Posted on

January 13, 2014 by

Daniel at

11:47 am

Unless you are planning to pay cash for your next real estate purchase, you will probably want to work with a mortgage broker in order to secure the best loan for your residential or commercial property investment. A mortgage broker acts as a intermediary between the loan applicant and the various banks and lending institutions, and they can help you find the best possible loan for your needs, your credit score and your budget. However, not all mortgage brokers are the same. This guide, along with resources like commercialview.com.au, can help you determine what key things to look for in a mortgage broker.

(more…)