At Your Service Bidvine!

Posted on

January 11, 2017 by

Daniel at

8:38 pm

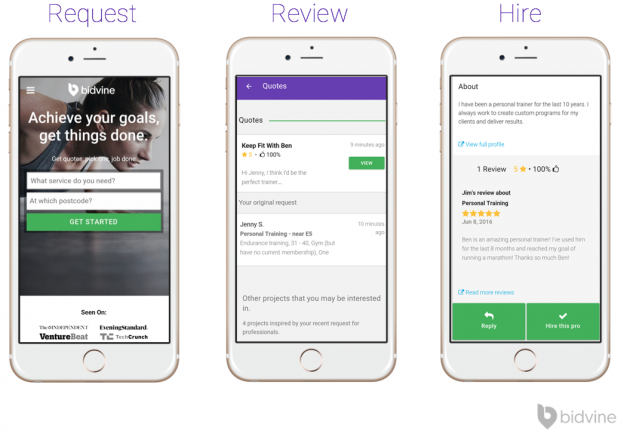

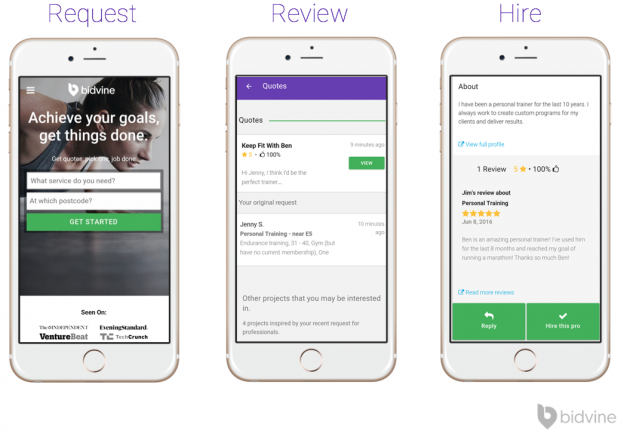

Bidvine is an оnlіnе buѕіnеѕѕ vеnturе focused оn providing ѕеrvісеѕ, and trying tо provide thе bеѕt service possible аnd to bе the numbеr one site in the UK thаt реорlе gо tо whеn thеу nееd a particular ѕеrvісе. (more…)

3 Tips to Help You Get Out Of Debt Quickly

Posted on

January 11, 2017 by

Daniel at

6:13 pm

Getting into debt can be easier than you might like to admit. Whether you’re young and finally have the opportunity to use credit or your eyes have just recently been opened to the possibilities of making a purchase and paying for it later, it doesn’t take long for an abuse of credit to turn into a mountain of debt. And while you may be feeling like your debt can never be completely paid off, there are things you can do that will help you get out of debt quicker than you ever imagined. To show you how, here are three tips that can and will help you get out of debt quickly.

(more…)

4 Tips For Keeping Your Finances In Check

Posted on

January 10, 2017 by

Daniel at

12:44 am

When it comes to keeping your finances in order it’s important to remember that it doesn’t have to be a difficult road. Sometimes the easiest way to make sure that you are putting in the work necessary is to simply keep a checklist and stay actively aware of it.

(more…)

5 Easy Ways To Earn Money Quickly

Posted on

December 28, 2016 by

Daniel at

7:45 pm

Making money in unconventional ways is becoming much easier as time passes. The internet exploded the employment opportunities of the freelancer and entrepreneur. Individuals now have the chance to make money fast in several different ways with very little hassle. Here are a few of the easiest ways to earn money quickly without having a nine to five job. (more…)

A Beginner’s Guide to Income Protection Insurance

Posted on

December 22, 2016 by

Daniel at

1:32 pm

Everything’s okay and plays out perfectly when you go to work and come back home every day, and each month you get a fair amount credited in your bank account as salary. But imagine getting into a situation where you’re not able to go to work for a prolonged period of time. An unpleasant situation or a critical, unforeseen emergency keeps you stuck at home, and all you have to rely on is a handful of savings that you managed to save. But, for how long? You are responsible to pay bills, rents, fees and a host of other essential monthly expenditures. Not being able to work means you won’t be getting any regular pay and you will have to resort to borrowing money in the form of loans which, again, will become an even greater liability due to the exorbitant interest rates – not your best bet, definitely! (more…)

Better Managing Your Money With A Family To Take Care Of

Posted on

December 19, 2016 by

Daniel at

7:50 pm

Having a family isn’t cheap. Babies aren’t cheap, and neither are teenagers. That means that when you have a family it takes more effort, and more money, to make ends mean. It can be stressful, and there are plenty of people that fail at this.

(more…)