Becoming a Certified Public Accountant takes time, but it pays in more ways than one. For starters, the median salary for CPAs in the U.S. is over $60,000 a year. It may not make you a millionaire, but a career as a Certified Public Accountant will certainly pay for a comfortable life.

If you are looking for a little direction in making a plan for the future, check out this short summary. We have highlighted a few of the most critical steps to becoming a successful CPA.

Professional duties of a CPA

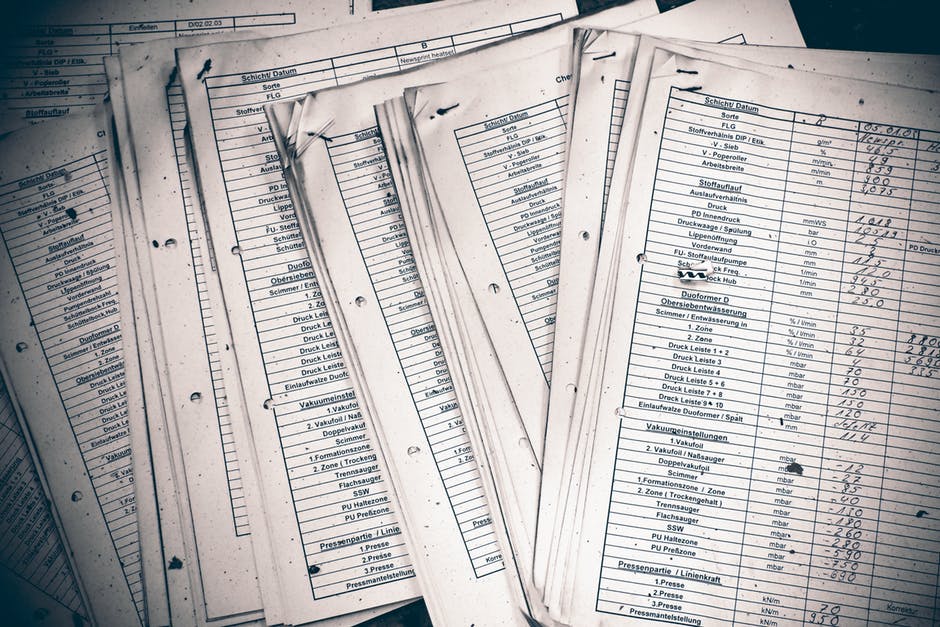

The job of a Certified Public Accountant includes analyzing financial data, preparing specific financial statements for clients, and clearly determining profits and losses for any given company.

All the calculations are typically processed through a computerized record-keeping system. CPAs are qualified to advise their clientele on subjects like employee benefits, estate planning, and company financial management.

Educational requirements for the job

Most states only require CPA applicants to hold a bachelor’s degree in business or some other related field, but some states require CPA hopefuls to earn a master’s degree before legally practicing.

Though working through the required educational requirements may take several years, there are plenty of opportunities for college students to grab up some real-time experience along the way. Take full advantage of any opportunities for employment in the field prior to graduation.

When to gain valued experience

As was mentioned in the prior section, it is recommended that CPA students take hold of every opportunity available to acquire experience in the field, prior to graduation. It is also possible to work as a junior accountant.

In this scenario, students learn valuable lessons from senior professionals in the workforce. Take every possible chance to step into the role of a CPA while still on the road to certification.

Obtain the proper certifications

For students who succeed in acquiring the proper educational requirements, certification is the next step towards a bountiful career. The CPA examination will consist of four separate parts.

Applicants are allowed to take the examination one section at a time, but are required to pass them all within a year and a half of passing the first section. The state in which CPA applicants intend to practice will have its own set of requirements for taking the Uniform CPA Examination.

Continue learning with CPE courses

Most CPAs are required by their state of certification to complete continuing education courses to keep professionals up to date on the most current financial laws and practices. Members of the AICPA (American Institute of Certified Public Accountants) are required to complete 120 hours of CPE courses every three years to keep their certification valid.